In this video, I am going to tear apart one of the most famous insurance schemes in India. Its LIC’s (New) Jeevan Anand scheme. I have taken this just as an example. There are many such schemes in the market which I don’t subscribe to. Such plans are extensively marketed because the insurance company and the agents get enormous money from them. But we have to be careful when dealing with our hard-earned money.

Lets take a quick look at the Jeevan Anand scheme.

Its a “Whole Life Endowment” policy. Let me break it down. The “Whole Life” means that on your death, whenever it happens, your dependents will get a certain amount. The “Endowment” means that your money will be invested on your behalf and then after a certain number of years, it will be returned to you with some interest.

I have already done a detailed analysis of this scheme in another video –https://youtu.be/15dgX1dSsDc.

In short, Jeevan Anand is an insurance cum investment scheme. Sure, it gives the convenience of investing your money and insuring your life in a single scheme. But, the cost of convenience becomes so expensive that you may better do some research before starting on such schemes.

In this video, I am going to propose a customized scheme for both your insurance and investment need. The beauty is that I am going to take the same premium amount of Jeevan Anand and play with it; no extra money is required.

Before, jumping into my scheme, let me just tell you that, for Jeevan Anand, I have taken the starting age of 25, term of 35 years for a coverage of 10 lakhs. And, the annual premium amounts to 28,282 rupees.

Lets call the customized scheme “THE SMART SCHEME”

First, I never wanna combine investment and insurance; so I split them.

If you ask me, “Term insurance” is the one and only the best insurance type. In short, the term insurance does not give you any money back; but provides the coverage amount to your dependents, if your death happens within the policy term. Thats the purest form of insurance. Though private companies offer cheaper alternatives, I will go with LIC for the argument sake.

So, as part of the SMART scheme, you will subscribe to LIC’s Amulya Jeevan scheme. For the starting age of 25, term of 35 years and for a coverage of 25 lakhs, your annual premium is just about 5900 rupees. You get better coverage for lesser premium. Your life is secured now for 25 lakhs instead of 10 lakhs with Jeevan Anand.

Then comes the investment part of the SMART scheme. Since you pay lesser premium for the term insurance, you save 22380 rupees a year. How you are gonna invest this money determines the success of my scheme.

We have already talked about SIP returns in another video –https://youtu.be/XDTzY6xMsA8. Though you may see more than 20% returns in that video, the history says it is wise to expect 12% annual return from the stock market in the long run.

So, as part of the scheme, you will invest in any of the long existing and top performing equity diversified mutual funds in a SIP manner. If you do the math, the savings due to the term insurance becomes 1865 rupees a month. You keep investing that amount in SIP every month for 35 years.

Smart Scheme = Term Insurance + SIP

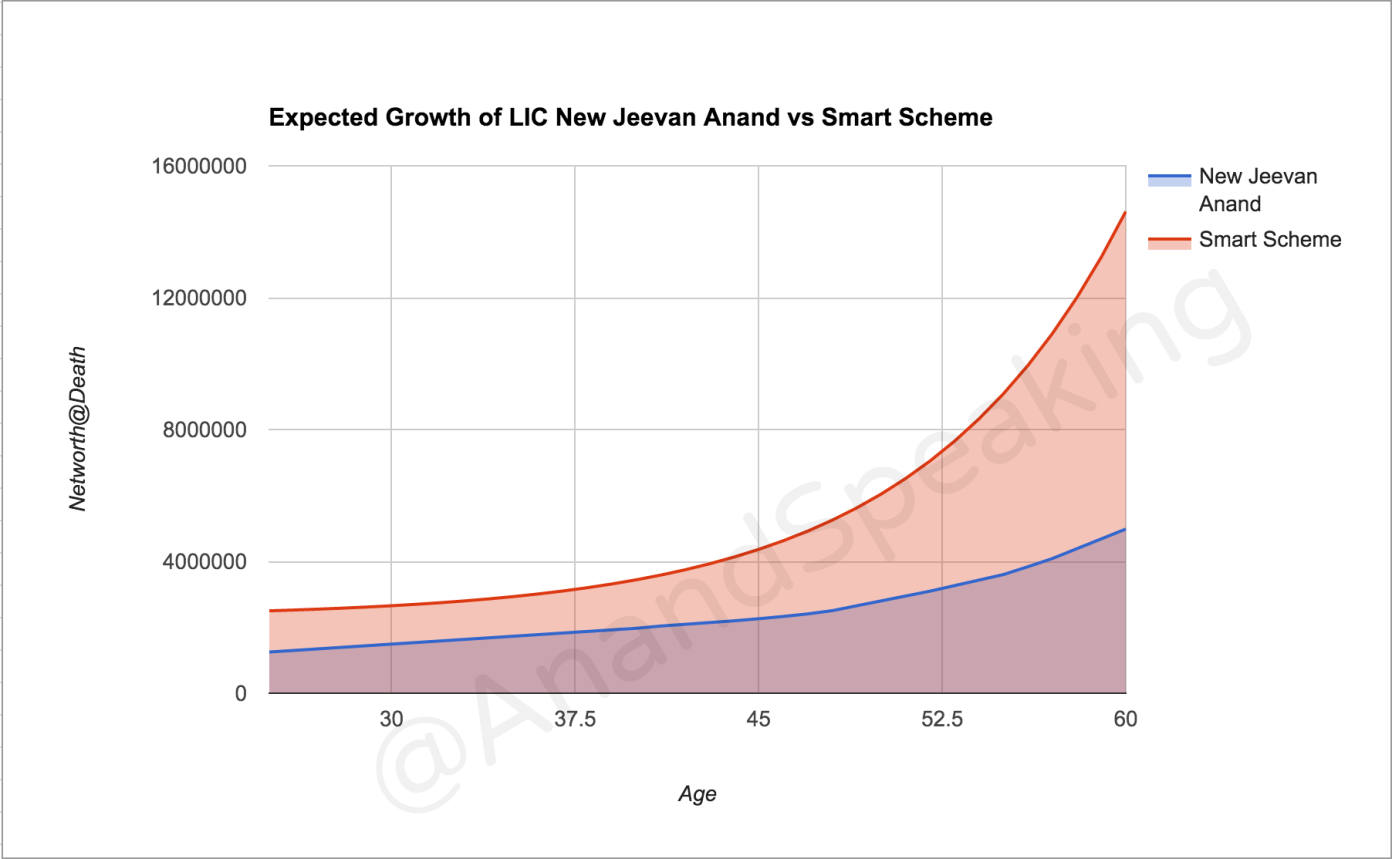

Now, with the plan completely laid out, lets see what would be difference in the amount that you or your dependent are expected to get at different stages of your life.

Lets see the chart for a short time, then we will deal with the numbers.

The red line covers the expected growth of SMART plan while the blue line below covers the expected growth of Jeevan Anand. Do you see how SMART plan is increasingly outperforming Jeevan Anand? The gap between the returns of the schemes is widening towards the end. Thats the magic of compounding. Your SIP delivers that magic.

To arrive at this smooth and beautiful chart, I have done an extensive analysis of both the schemes year by year. Well, I love playing with numbers

Enough of the chart. Lets look at the numbers. I tend to utter the word “Death” many times in the video, but just don’t mind. ok.

Lets look at the first case. The death happens at the age of 25 just after taking the policy. Jeevan Anand gives you 12.5 Lakhs. Whereas the Smart scheme gives you 25 Lakhs. The entire 25 Lakhs comes from the Term insurance. You are double smart with the Smart scheme.

In the second case, the death happens at the age of 45. That is 20 years into the scheme. Your SIP would have grown to a substantial amount by this time. About the difference, Jeevan Anand gives you 23.28 lakhs whereas the Smart scheme gives you 43.63 lakhs. Out of which, 18.63 lakhs comes from SIP investments. Even here, you are double smart.

In the third case, the death happens at the age of 60 before the policy expiry. Here, Jeevan Anand gives you 52.5 lakhs whereas the Smart scheme gives you… any guess?… a whopping 1.46 crores!!! Subtracting the 25 lakhs coverage from the term insurance, your SIP is expected to deliver 1.21 crores at this time. Again, the SIP returns are calculated with the conservative return of 12% a year. If you do the math, you are nearly three times smart with the SMART scheme.

Then lets looks at the most optimistic and most desirable scenario. That you survive for the entire duration of the policy and you are now 60 years old. With the SMART scheme, the term insurance policy has expired now and you don’t get any amount from the policy. Forget about it for the rest of your life. Since you are not earning anymore, the idea is you don’t need life insurance anymore. But you have accumulated your investments on SIP. The networth of the Smart scheme now is 1.21 crores coming entirely from your SIP investments. Compare it with 49.5 lakhs from Jeevan Anand.

Not to miss the “whole life cover” aspect of Jeevan Anand, you will get 10 lakhs at anytime the death happens. But you can easily get that 10 lakhs with the SMART scheme. Just invest 1.21 crores in a Fixed Deposit scheme and you can easily overshoot 10 lakhs in a year.

So far, we have seen in any stage of your life, the SMART scheme appears to outperform Jeevan Anand by a huge margin like 100% or 200%.

For long term investments, equities are the best. And, SIP averages out the market fluctuations and gives you steady returns over the years.

I want to end by saying don’t trust me or any investment consultant blindly, do your own research and get convinced of your decision. For example, if you are not convinced, then you will most likely stop or withdraw the SIP at the time of market crash. You will not realize that these are the moments of opportunities that SIP utilizes for a steady growth of your investments.

Think over it and make a wise decision before choosing schemes like Jeevan Anand. That marks the end of the post.

If you liked the post/video, give a thumbs up and leave some comments. Also, feel free to share the post/video with your friends and family if it is useful. For more such videos, you may wanna subscribe to my YouTube channel.